CAMELS ANALYSIS

Camels analysis is a risk based monitoring system used in many countries worldwide including Turkey, in order to determine the general situation of banking system by the supervisory authorities. This analysis is also used by rating companies during their studies on rating banks.

The letters in Camels stands for;

C - Capital adequacy

A - Asset quality

M - Management quality

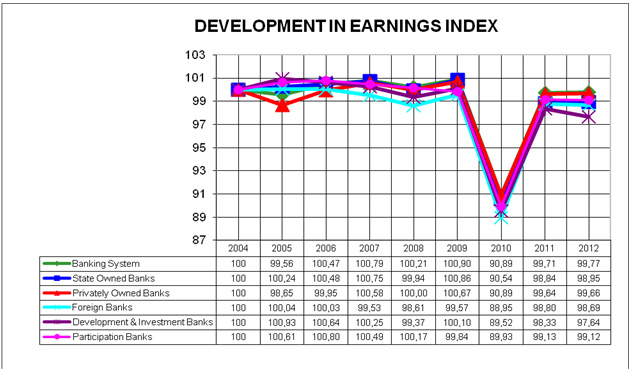

E - Earnings

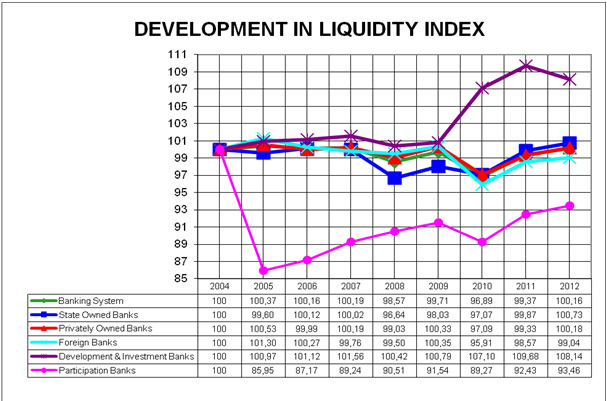

L - Liquidity

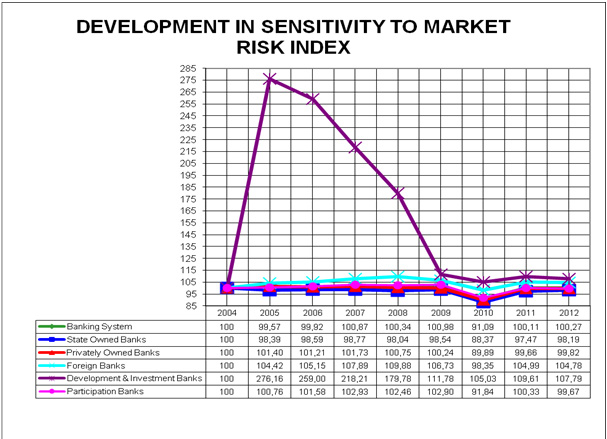

S - Sensitivity to Market Risk

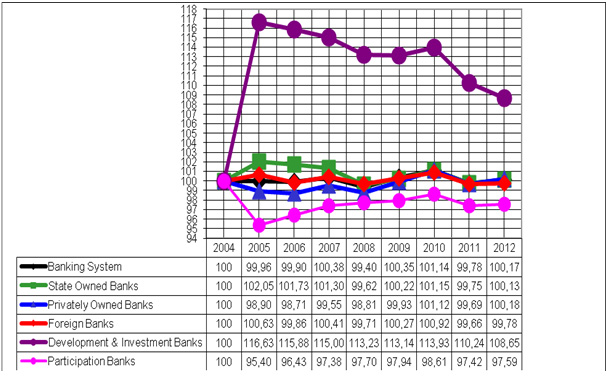

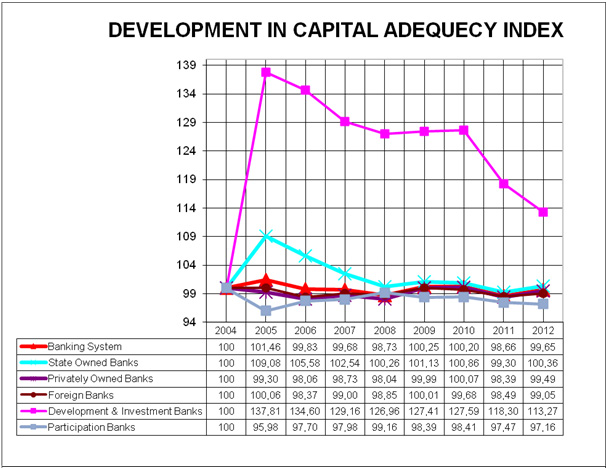

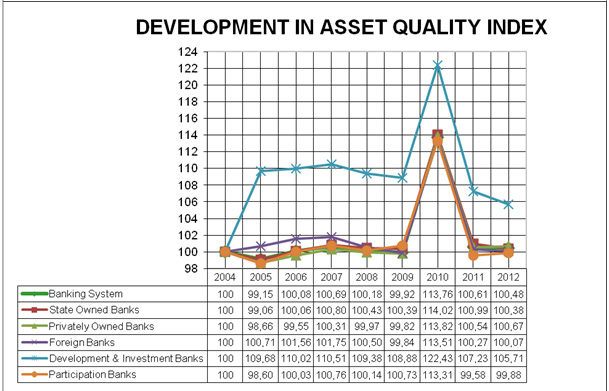

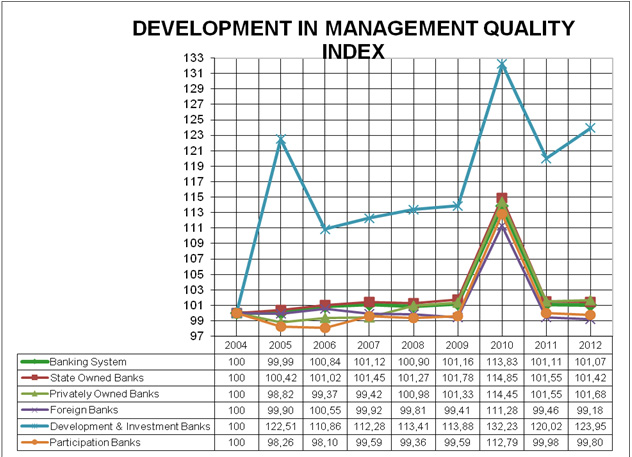

In our study, due to difficulties in signifing and/or monitoring banking criterias with a single indicator, we used “Composite Indicator – Performance Index” which has been used for a long time in developed economies.

Our study, taking 2004 as the basis point shows the development of performance index both in banking system in general and in sub groups, as of 2005 – 2012 year ends. In our study BRSA’s Interactive Monthly Bulletin year end data are used.

DEVELOPMENT OF CAMELS ANALYSIS-PERFORMANCE INDEX AS OF 2005-2012 YEAR ENDS

Breakdown of Camels Analysis components as of 2005 – 2012 year end in both banking system and in sub groups are shown below.

The study executed by KOBIRATE A.Ş. depending on banking system year end financials derived from BRSA’s Interactive Bulletin are going to be updated each year end.